Navigating the complex world of sales and use taxes can be a daunting task for businesses, especially those operating across multiple jurisdictions. Sales and use tax software streamlines this process, providing accurate calculations, compliance management, and significant cost savings. This comprehensive guide dives deep into the benefits, features, and considerations for choosing the right sales and use tax software solution.

Understanding Sales and Use Taxes

Sales taxes are levied on the sale of goods and services, while use taxes apply to the use, storage, or consumption of tangible personal property. Understanding the nuances of these taxes, varying by state and locality, is crucial for accurate calculation and reporting. Different states have different tax rates, exemptions, and reporting requirements, making manual calculations prone to errors.

This is where sales tax software excels.

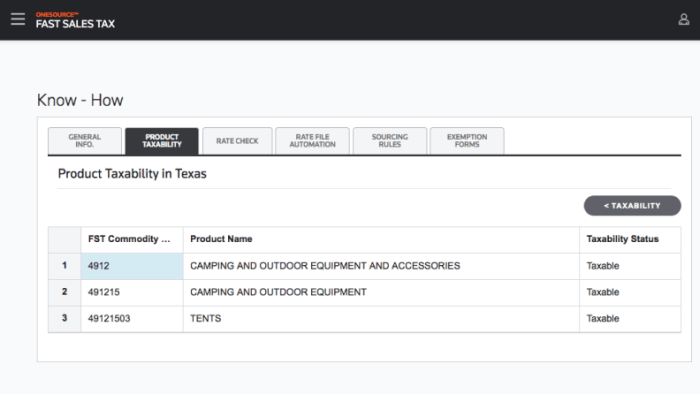

Source: thomsonreuters.com

Key Components of Sales Tax Software

- Tax Rate Management: Accurate and up-to-date tax rate information is critical. The software should automatically update rates as jurisdictions change.

- Transaction Tracking: The software must effectively track sales transactions, including the location of the sale, the applicable tax rates, and any exemptions.

- Tax Calculation and Reporting: The software should automate the calculation of sales and use taxes, ensuring accuracy and minimizing manual errors. It should generate reports suitable for compliance.

- Compliance Management: Software should help businesses stay compliant with all applicable tax regulations, including deadlines and reporting requirements.

- Inventory Management (Optional): Some solutions integrate with inventory systems, enabling more accurate tax calculations based on inventory value and location.

Benefits of Using Sales Tax Software

Beyond basic compliance, sales tax software offers numerous advantages:

Accuracy and Efficiency

Automation minimizes errors in tax calculations, ensuring accurate reporting and preventing penalties. This leads to significant efficiency gains by freeing up valuable time for other business tasks.

Source: co.za

Reduced Compliance Risks

Software often includes features for tracking deadlines and ensuring timely filing. This reduces the risk of penalties and ensures compliance with all relevant regulations.

Cost Savings

By automating calculations and reporting, businesses can avoid the high costs associated with manual errors and potential penalties. The cost savings can be substantial, particularly for businesses operating in multiple states.

Choosing the Right Sales Tax Software

Several factors influence the selection of the right sales tax software. Consider these crucial points:

Scalability and Future Growth

As your business expands, your needs for sales tax management will likely evolve. Choose software that can scale with your company’s growth.

Integration with Existing Systems

Ensure seamless integration with your existing accounting and inventory management systems to minimize data entry and improve overall efficiency.

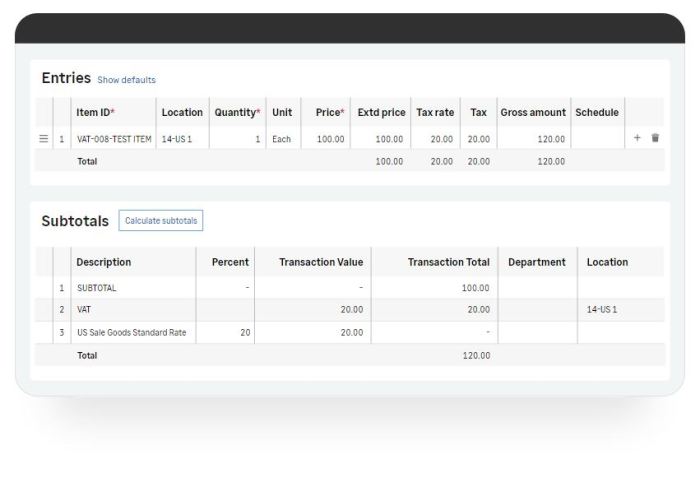

Source: shopify.com

User-Friendliness, Sales and use tax software

Intuitive software is key to ensuring smooth adoption and maximizing user productivity. Consider user training and support options.

Frequently Asked Questions (FAQ)

- Q: How much does sales tax software cost?

A: Pricing varies significantly depending on features, complexity, and the number of states covered. Contact vendors for specific pricing details.

- Q: Can sales tax software be used by small businesses?

A: Absolutely! Many user-friendly options are available tailored to the specific needs of small businesses.

- Q: Is sales tax software necessary for all businesses?

A: While not strictly mandatory for all businesses, it is highly recommended for those operating in multiple states or with complex tax structures.

- Q: How do I ensure the software is up-to-date with the latest tax laws?

A: Reputable software providers usually offer regular updates and support to keep their systems compliant with the latest changes in tax regulations.

Conclusion

Sales and use tax software is a vital tool for businesses navigating the complexities of state and local tax regulations. By automating calculations, streamlining compliance, and reducing errors, these solutions can save businesses significant time and money while ensuring legal compliance. Careful consideration of factors such as scalability, integration, and user-friendliness is essential when selecting the right solution for your needs.

Resources

For further information, explore these resources:

Call to Action

Ready to simplify your sales and use tax processes? Contact us today for a personalized consultation and discover how our sales tax software can benefit your business. We can help you find the right solution to fit your needs and budget. [Link to your website or contact form]

Key Questions Answered: Sales And Use Tax Software

What types of businesses benefit most from this software?

Businesses with significant sales transactions across multiple jurisdictions, those that sell online or through marketplaces, and those with complex sales structures benefit greatly from sales and use tax software. It streamlines the process, reducing the potential for errors and saving time.

How can I choose the right sales and use tax software for my business?

Consider factors such as your business size, the number of transactions, and the complexity of your sales structure. Read reviews, compare pricing, and evaluate the software’s features and functionalities. Ensure the software integrates with your existing accounting system if needed.

What is the typical cost of sales and use tax software?

Software costs vary significantly based on features, functionalities, and the number of users. There are often tiered pricing plans, ranging from basic plans for small businesses to enterprise-level options. It’s best to contact providers directly for detailed pricing information.